Imagine a network where artificial intelligence models operate like independent startups—each with its own mission, goals, and potential to create value. That’s exactly how Bittensor subnets work. They are the building blocks of the decentralized AI ecosystem, providing specialization, scalability, and investment opportunities in a rapidly evolving landscape.

🌐 What Are Subnets?

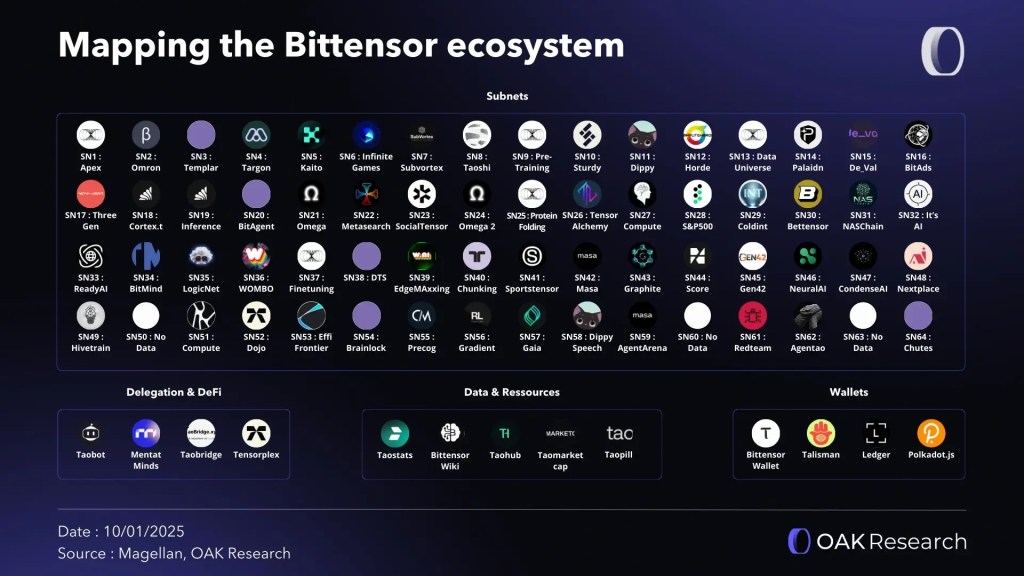

In the Bittensor ecosystem, a subnet is a specialized section of the network focused on a particular AI task. Instead of having one giant model trying to do everything, subnets allow AI models to specialize. Think of them as mini-ecosystems within the broader Bittensor network.

Each subnet operates like an independent AI startup. Investors can participate early, contributors can train models, and validators ensure outputs are accurate and valuable. The best-performing subnets earn more TAO rewards, and the growth of a subnet is reflected in the value of its contributions.

This structure provides several advantages:

- Specialization – Each subnet can focus on a specific AI domain, from drug discovery to autonomous AI agents.

- Scalability – As new problems arise, new subnets can launch without affecting the rest of the network.

- Investment Potential – Early participation in promising subnets is like getting in on the ground floor of AI startups.

🔍 How Subnets Work

Subnets rely on three key players:

- Miners/Contributors – They provide data and computational resources to train AI models within a subnet.

- Validators – They check outputs for accuracy, ranking peers and determining TAO rewards.

- Delegators – Investors can delegate TAO to a subnet, effectively supporting promising models and earning rewards based on performance.

The performance of each subnet is dynamic. Models compete and collaborate, creating a constantly evolving ecosystem where innovation is rewarded.

💡 Notable Subnets

NOVA – Drug Discovery

NOVA focuses on AI-driven drug discovery. By training models on biochemical data, NOVA accelerates the search for new treatments and therapeutics. Investors participating in NOVA are effectively gaining early exposure to breakthroughs in healthcare AI, with the upside tied to the subnet’s success in producing valuable models.

Ridges – AI Agents Competing with Centralized Giants

Ridges is a subnet where AI agents tackle complex tasks that centralized AI companies dominate today. From autonomous problem-solving to natural language understanding, Ridges allows contributors to test models in a competitive, decentralized environment. Early investors can stake TAO in Ridges, gaining exposure to potentially disruptive AI applications before large corporations scale them.

These examples show that subnets aren’t just abstract technical constructs—they are AI startups you can interact with, contribute to, and invest in.

⚡ Why Subnets Matter for Investors

Subnets turn Bittensor into more than a network—they create a decentralized investment playground:

- Early Access – Supporting a subnet early gives you exposure to innovation before it becomes mainstream.

- Diversification – You can allocate TAO across multiple subnets, spreading risk across different AI domains.

- Performance-Based Rewards – The better a subnet performs, the higher the TAO rewards for contributors and delegators.

- Transparency – All contributions, performance metrics, and rewards are recorded on-chain, ensuring trust.

Investing in subnets is like backing multiple AI startups at once, without needing insider access or millions of dollars.

📈 How to Participate

Getting involved in subnets is straightforward:

- Choose a Subnet – Look at the focus area (e.g., NOVA, Ridges) and assess your interest or expertise. Check out these links to explore the vast list of subnets.

- Contribute or Delegate – If you have data or compute power, you can train models. If you want a more passive role, delegate TAO to validators supporting the subnet.

- Monitor Performance – Each subnet’s success is dynamic. Track contributions, peer rankings, and TAO rewards.

- Diversify Across Subnets – Spread your stake to reduce risk and increase exposure to different AI domains.

The combination of active contribution and strategic delegation allows both investors and learners to participate meaningfully in the ecosystem.

🔹 Key Takeaways

- Subnets are the building blocks of Bittensor, each focusing on specialized AI tasks.

- Early participation = early exposure, much like investing in AI startups.

- NOVA and Ridges highlight the diversity and potential impact of subnets.

- Contributors, validators, and delegators all play roles in driving subnet success and earning rewards.

By understanding subnets, investors and AI enthusiasts can see how Bittensor decentralizes intelligence creation, opens investment opportunities, and empowers global collaboration.

Bittensor isn’t just a network—it’s a decentralized launchpad for the next generation of AI innovation. Subnets give you the chance to get in on the ground floor and ride the growth of decentralized AI from day one.